Gigabyte has just published its June revenue figures, giving us our first look at Q2 earnings for the Taiwanese company compared to its bumper Q1… and it doesn’t make for pretty reading. With the slump in graphics card sales, due to slackening mining demand, and gamers weary of high prices and an impending new generation of Nvidia GPUs, it looks like Gigabyte’s GPU division is tracking some $6 million down on Q1.

That’s only an estimate, based on previous figures for its less-volatile non-GPU business, but if it’s true then its Q1 – Q2 graphics card revenue is potentially down around 58%.

You’re probably waiting for a new GPU, but now’s the time to invest in one of the best gaming monitors around.

The sad truth of it is that, without an imminent launch of the Nvidia GTX 1180 graphics cards – and the subsequent mainstream GPUs – that trend is going to continue with Q3 likely to be even worse. Gigabyte at least had a couple of months of decent sales in this quarter, but with the new cards not likely to arrive in retail until September, July and August will see even weaker GPU sales.

Gigabyte’s situation is not going to be an isolated case either, with other GPU manufacturers likely to also be feeling the pinch as the graphics card bust follows the mining boom times. Gigabyte at least has a pretty static non-GPU business that it can call on, and it’s that stable portion of its revenue stream that allows us to estimate just how bad things have got on the graphics side.

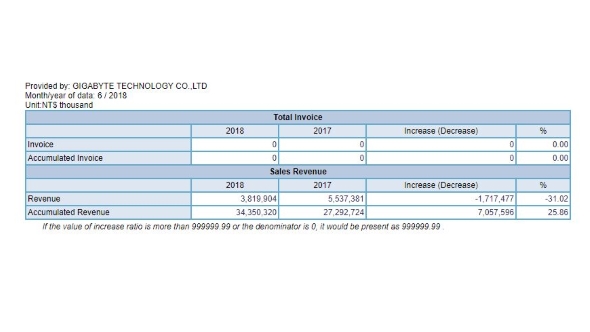

A post on Seeking Alpha explains that, with the non-GPU revenue being generally pretty flat, and accounting for 49% of the business in Q1, we can estimate its Q2 GPU revenue. In total Gigabyte made a little over $20m in Q1, with slightly more than $10m of that coming from graphics card sales and just under $10m from the non-GPU side. The latest figures released for Q2 show total revenue for April, May, and June being just over $14m.

Take away the expected ~$10m in non-GPU revenue and that leaves you with just around $4m coming from GPU sales over the last three months. The sales report also shows that June in particular is the company’s worst month for total revenue since December 2016.

With all expectations pointing to a September launch, after an August unveiling, for Nvidia’s next generation of graphics cards, it’s hard to see how GPU sales are going to be up to anything at all throughout July and August. The collapse in the GPU mining economy coupled with the lack of interest in gaming cards simply wasn’t expected – if it was maybe Nvidia would have chosen to launch its new cards a little sooner.

Nvidia did say that Q2 mining demand would be about a third of what it was in Q1, but expected the slack would, at least in part, be taken up by increased quarter-on-quarter, and year-on-year gaming demand.

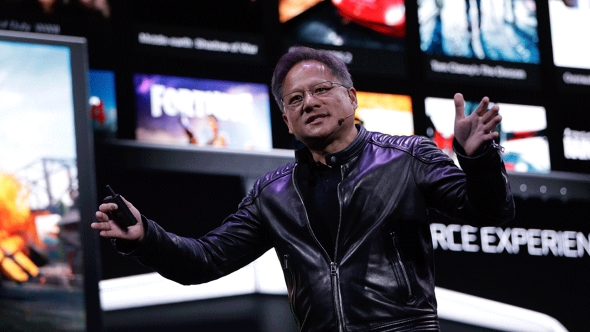

“We’re expecting Q2 to be better than Q1,” Jen-Hsun Huang explained in Nvidia’s Q1 earnings call. “And we’re expecting Q2 to be better than seasonality.”

It doesn’t look like that’s how it’s going to pan out for Nvidia, and not for its add-in board (AIB) partners either. This is the lowest June revenue figures Gigabyte has put out since 2012, showing it is not beating seasonality…

Thankfully everyone’s been filling the coffers because of the earlier mining boom, and so are still ahead for the year. But if the new cards had been penned in for the end of Q2 rather than the end of Q3 this blip could have been ironed out quite quickly.

As it is, Nvidia’s choice to hold back the launching of a new generation of gaming graphics cards until September means that there are another tough couple of months ahead for all the AIBs.