Nvidia’s $6.9bn purchase of networking company Mellanox is a part of a wider pivot towards the datacenter, CEO Jen-Hsun Huang says. Unless you’re familiar with HPC networking, you probably haven’t heard of Nvidia’s latest acquisition or its work. All you need to know is that the green team spent a mammoth amount of money to pip Intel to the purchase and start its ascent unto corporate data Valhalla.

It’s no secret that Nvidia is hoping to bump up its datacenter revenue and shift away from its dependence on gaming revenue – “the more you buy, the more you save” was CEO Huang’s go-to catchphrase in 2018. With growing applications for GPUs outside of our gaming rigs, it’s no surprise the green team spent record dosh purchasing one of the leading big data interconnect companies out there. And, if you didn’t think gamers are second-fiddle already, Huang’s latest interview is pretty telling.

“Datacenters are the most important computers in the world today,” Huang says in an interview with HPCwire, “and in the future – as the workloads continue to change triggered by artificial intelligence, machine learning, data analytics and data sciences – future datacenters of all kinds will be built like high performance computers.

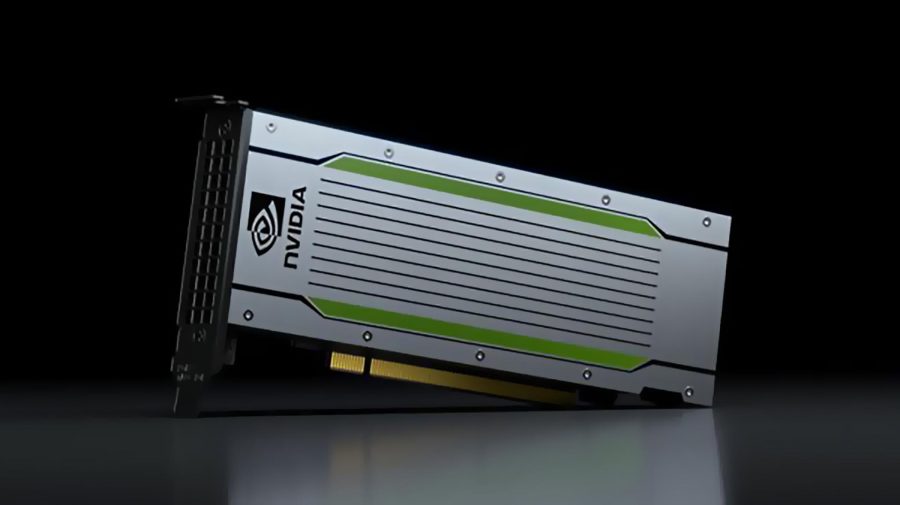

“We were a GPU company and then we became a GPU systems company. We became a computing company which started from the chip up, now we are extending ourselves into a datacenter computing company.”

Latest tech: Here’s how Nvidia’s GTX 1660 shapes up

Mellanox is a networking company building interconnect technology for use in datacenters and HPC. Its strategy is to offload networking tasks from the CPU and onto dedicated network hardware. Nvidia has already utilised Mellanox NIC tech within DGX-2, “the world’s largest GPU”, which also featured Nvidia’s own NVSwitch interconnect.

“We believe that in future datacenters, the compute will not start and end at the server,” Huang continues, “but the compute will extend into the network…. Long-term, I think we have the opportunity to create datacenter-scale computing architectures; short-term, Mellanox’s footprint in datacenters is quite large.”

The acquisition could put Nvidia in a very enviable position. It will have the tools to create end-to-end datacenter solutions – GPU, on-chip and external interconnects, networking, the works – and all the while minimising the need for its rival’s CPU technology.

And while Huang claims its relationship with its rivals is not an antagonistic one, reiterating that Nvidia has no interest in developing its own CPU, there’s certainly a storm brewing between it and x86 CPU pioneer Intel.

Intel is also looking to capitalise on the world’s “data explosion”, as Raja Koduri, head of Intel’s Core and Visual Computing Group, puts it. Intel was reportedly in the runnings for Mellanox, and is expected to launch its own discrete graphics products “that scale up from the low power, mobile domain up to petaflops – the big data center GPUs” starting in 2020.

Yet despite Huang’s best efforts to pivot away from the gaming side of things, most notably with the Volta architecture launched in 2017, us gamers still remain its largest and most lucrative cash cow. Gaming accounted for $954 million in sales in Q4 last year, while the datacenter managed $679 million. However, datacenter sales were up 12% for the quarter, while gaming was down 45% – no doubt affected by the crypto-bubble.