This year has been busy for us hardware enthusiasts, with AMD finally returning to form and heating up the competition – largely thanks to their Ryzen processor’s success. Through Q3 of 2017, AMD have managed to turn over a net income of $71 million, up 26% from Q3 2016, pushing them back into the black.

Get the most out of your PC with the best SSD on the market.

AMD shareholders rejoice! Earnings per share have risen from a loss of $0.02 per share last quarter, to a profit of $0.07. AMD’s operating income has finally swung back in their favour, from a devastating loss of $293 million in Q3 2016, to a $126 million income this time around. Sure, compared to their Q3 revenue of $1.64 billion it seems a little on the low side, but it’s a start.

These are GAAP financial results, or generally accepted accounting principles, although some results offered by AMD are non-GAAP, and sway more in their favour.

AMD’s president and CEO, Dr. Lisa Su, believes that “strong customer adoption of our new high-performance products drove significant revenue growth and improved financial results from a year ago.” All of AMD’s hard work in their computer and graphics department is the key to their success, making up just less than half of their entire revenue.

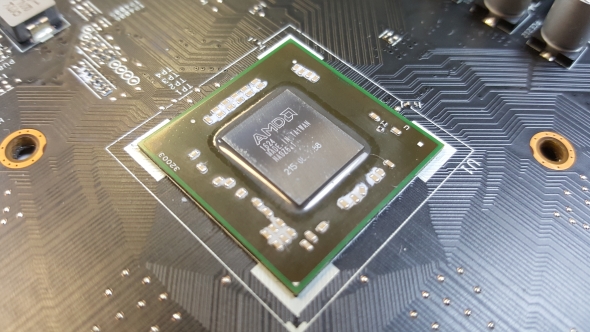

Ryzen chips have significantly increased AMD’s average selling price, no doubt partially due to their foray back into the high-end desktop processor space with Threadripper. If Ryzen Mobile is widespread adopted by OEMs, this could be yet another winner for team red.

AMD paid out a huge sum of $340 million in Q3 of last year to amend their wafer agreement with Global Foundries, and this has led to a huge, albeit skewed, 35% increase in gross margin year-over-year.

No doubt that the shortage of AMD cards due to their high mining aptitude has aided AMD’s GPU department, with professional cryptocurrency miners snapping up cards faster than AMD can seemingly manufacturer them. Despite Polaris-based 400-series and 500-series cards being some of our top picks for the best graphics cards since their release, the Radeon Technologies Group were struggling to get rid of the speed demons, at least until miners came along, causing a mammoth boost in GPU sales and average selling price. Ah, the good ol’ days, when AMD were operating in the red, but at least we could pick up a solid graphics card at less than MSRP.

Console sales – largely reliant on custom AMD tech – have been a saving grace for AMD in the past, although seemingly have seen little growth in 2017. It seems that the successful launch of AMD’s EPYC server juggernauts helped offset what was otherwise a slow year for AMD’s SoC, enterprise, and custom chip sales. Although this could all change in AMD’s favour, dependent on the success of the soon-to-be released Xbox One X.

It’s not all elated celebration over at AMD, however, with their Q4 forecast looking a little overcast, and graphics cards are returning to the shelves at somewhat reasonable prices, which is great news for us gamers. Shares have already plummeted nearly 12% off the back of the forecast warning, but nevertheless, news of AMD’s success is encouraging, and it holds off – for now – some of the tough realities that may have faced us hardware enthusiasts had we ended up with a one-horse race.