AMD has posted its financial results for the third quarter of 2018. The red team had a rather symbiotic relationship with cryptocurrency miners during their time in the sun, but it looks like that’s finally come to a rather abrupt end. AMD is now reporting a ‘negligible’ revenue gain from miners during its third quarter revenue, and it may still be holding onto more GPU stock than it has use for.

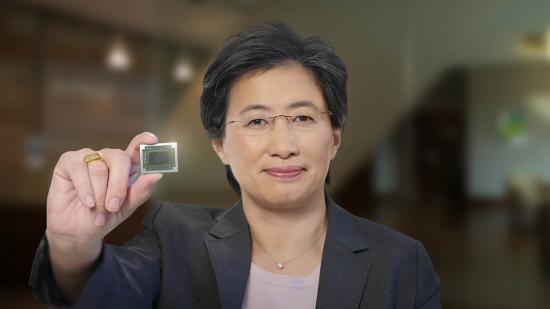

AMD’s revenue is up four percent year-over-year, for a total of $1.65 billion. That’s actually a little shy on the $1.76 billion in revenue AMD managed to scoop into its giant maw last quarter – and $50 million short of its prospective earnings for the quarter – and CEO Lisa Su attributes that to graphics revenue slowing down as the year comes to an end.

Those meddling cryptocurrency miners really did a number on graphics cards towards the end of 2017 and into the first quarter of 2018. AMD was affected most of all, with its GPUs found to be extremely proficient at raw computation and, as such, were perfect for cryptocurrency miners chasing a quick turnaround on investment. That all played into strong figures for the red team’s graphics segment at the start of the year.

The Santa Clara company received serious dividends from the crypto-craze, but with Bitcoin now valued at $6,430 and mining ruled entirely by giant farms, that’s all come to an end. AMD, like Nvidia not long before it, is now claiming ‘blockchain-related GPU sales’ accounted for next to nothing in Q3.

“In graphics, the year-over-year revenue decrease was primarily driven by significantly lower channel GPU sales,” AMD CEO Lisa Su says, “partially offset by improved OEM and datacenter GPU sales. Channel GPU sales came in lower than expected, based on excess channel inventory levels, caused by the decline in blockchain-related demand that was so strong earlier in the year.”

It looks like AMD fell victim to its own hopeful expectations of the blockchain business, inadvertently flooding its own channels with GPUs once the cryptocurrency market fell off the cliff. Nvidia reportedly fell foul of the same thing, producing huge swathes of GPUs to meet demand of both miners and gamers that subsequently were left sitting in the channel like a stranded P&O ferry.

AMD is expected to launch the RX 590 in the very near future, which could help its graphics business out of its recent rut.

But the graphics segment is still riding the coattails of AMDs booming CPU business, which is managing to keep the Computing and Graphics segment buoyant and well above water even after crypto has slid into obscurity. The locomotive behind AMD’s past few successful years is its Ryzen CPUs, which have propelled the red team into profit. This hasn’t changed, with Ryzen offsetting graphics in the Computing and Graphics segment’s revenue for the quarter. Gross margin and average selling price were both up on Ryzen’s count, too.

EPYC server sales were similarly keeping Enterprise, Embedded, and Semi-Custom going, which was down five percent year-over-year but up seven percent from last quarter for a total of $715 million. AMD will surely net itself some strong console sales if Sony’s PlayStation 5 launches next year – reportedly built on the AMD Navi architecture – but until then it’s EPYC server sales that AMD touts as offsetting its slow semi-custom game.

AMD’s stock has subsequently taken a slide in light of its Q3 financials, currently sitting at a pre-market value of $18.80. However, AMD’s outlook for the rest of the year is still up year-on-year, with a revenue of $1.45 billion, plus or minus $50 million, expected in Q4 – that’s roughly an eight percent increase on last year’s Q4. AMD expects its 7nm Vega 20 GPU, making its way out to enterprise later this year, to help drive sales going into the new year, with both the new 7nm Zen 2 CPUs and Navi GPUs arriving sometime 2019 too.