TSMC are already responsible for all of Nvidia’s 16nm Pascal and 12nm Volta chips, but they also supposedly just netted themselves the deal for all of Apple’s upcoming iPhone processors. That may be a huge business venture, but surprisingly, the cryptocurrency boom is a money-printing machine for TSMC and it’s expected to grow quicker than their giant exclusive phone or GPU deals.

Grab yourself the best gaming headset around.

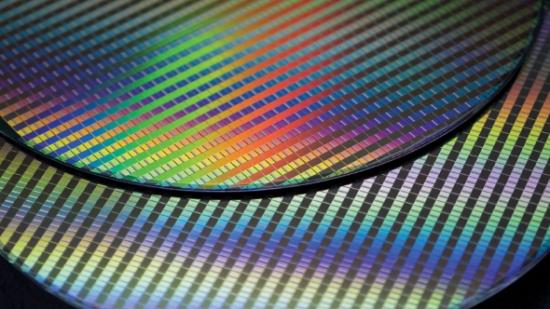

You know Taiwan Semiconductor Manufacturing Co., right? They are the company that historically fabricated most of Nvidia’s chips, so even if you aren’t familiar, you more than likely own one of their products – at least, that’s the case if Steam’s Hardware Survey numbers are at all accurate.

Cryptocurrencies have already bolstered shares in AMD and Nvidia, but TSMC are also happily riding the same wave while it lasts, and crypto-chips are expected to become their fastest growing sector in 2018.

Supposedly ASIC-miner manufacturer and retailer, Bitmain, are making up a huge quantity of TSMC’s 16nm node sales and funding their rapid growth. According to a source of Ark Invest, employee James Wang, “Bitmain is buying ~20k 16nm wafers a month. That’s more than Nvidia.”

TSMC — the world's largest chip factory — is all about crypto all of a sudden.

Bitmain is buying ~20k 16nm wafers a month. That's more than Nvidia. pic.twitter.com/ivZOqXvJXu— James Wang (@jwangARK) January 19, 2018

Fear not, miners probably aren’t stealing our precious silicon wafers right out of Nvidia’s grasp, but it does offer some insight into how rapidly mining demand has soared, and the sheer quantity of ASIC-miners that are potentially entering into service for Bitcoin mining. This won’t mean much for GPU shortages, however, as Bitcoin is already far beyond GPU mining potential at this point, but plenty other coins remain profitable on graphics tech.

In the third quarter of 2017, mining sales netted the company $350 to $400 million in revenue, and, according to Bloomberg, could easily double in 2018 to around 10% of the company’s revenue.

TSMC are also unleashing a new fab this week to produce their new 5nm process node. No, we won’t be seeing 5nm GPUs or processors anytime soon, but it’s only a matter of time with AMD already well into development of their 7nm Navi architecture supplied by rival fab GlobalFoundries, and will be shipping a 7nm AMD Vega GPU towards the end of the year.

Cryptocurrency mining has been a profitable venture, not only for miners, but also for the companies further down the manufacturing line. TSMC may be uneasy with relying on any consistent promise of income from the crypto-channel than your average miner, but the potential to make a lot of money is seemingly too alluring to turn down. And why would they? TSMC won’t be worrying about the crypto-bubble popping as they’ve still got a consistent market elsewhere.