Graphics card makers are still counting the cost of the weak cryptocurrency mining demand and are expecting to see shipments fall even further for the rest of this year. But that hasn’t stopped them from still maintaining artificially high margins for their GPUs, even though supply is high and demand is relatively low. I wonder why…

DigiTimes is reporting the Taiwanese add-in board partners (AIBs) – Asus, Gigabyte, MSI, and TUL – are all now holding large inventories of stock, but are still keeping their gross margins at around 20%. For reference, at the start of last year the same graphics cards held margins of 8-10%.

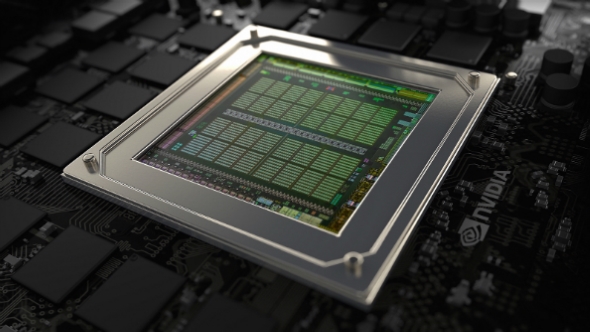

The GPU is the superstar of the gaming PC, but it would be nothing without the best gaming monitors.

That is still a pretty considerable drop compared with the height of the GPU mining boom, where they were able to add on margins of 40-50% on top of the standard retail price, but despite miners no longer investing in graphics cards as they once did the prices remain artificially high.

The DigiTimes report claims that because of the weak mining demand for the rest of the year the AIBs are now turning back to the traditional gaming audience to keep their revenue momentum going in the right direction.

Both Bitcoin and the GPU-based currencies, such as Etherium, have suffered further price drops over the last few months, with a seven-month low pulling the markets down last week.

And while the prospects don’t look none too positive for the crypto-mining boom times to return any time soon – boosting the falling profits of the GPU manufacturers – it might seem odd that they’re stubbornly holding onto their high margins in the face of a large volume of cards sitting in the channel.

You could easily put that down to greediness on their behalf, not wanting to give up on the chance of cashing in on the last vestiges of GPU demand, but I’m not convinced it’s that simple. I’m fairly sure it’s because they’re aware there is a new generation of Nvidia GPUs lurking just over the horizon.

There have been reports that the AIBs are starting to brief their engineers on the specifics of the new GeForce cards, and if they are coming in the next few months, as is widely expected, then they would have received some sort of notification by now.

If they were convinced the graphics card status quo was going to stick around for the foreseeable then they could confidently play the long game and drop their margins back to previous levels. But by keeping their margins as high as they can reasonably get away with it looks like they’re simply cashing in on the current-gen stock as much as they can for the short term before the next-gen Nvidia GTX 1180, GTX 2080, V80 GTX, or whatever they end up being called, finally drop into their factories.

Or maybe they are just being super stubborn…