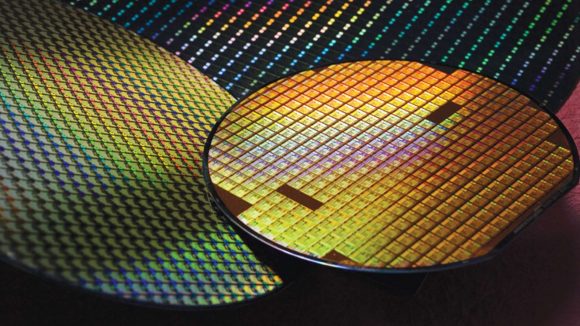

Despite spending another $116bn on its foundry business Samsung is never going to be able to overtake TSMC as the top dog. That’s the main takeaway from industry analysts assessing the Korean giant’s attempts to shift the base of contract manufacturing power away from Taiwan and TSMC.

Part of the issue is the amount of money the Taiwanese manufacturer pumps into the research and development side of its business, something which Samsung can’t really match even with this huge multi-year investment. Analysts are claiming that out of that $116bn Samsung will still only be cashing in around half the annual R&D spend of TSMC, and that is only going to perpetuate the company being “the ‘number two’ foundry business.”

The other part of the equation counting against Samsung is its Galaxy smartphones. One of the key parts of TSMC’s rise to dominate the contract foundry business is not its work with AMD and Nvidia to create their processors and graphics cards, it’s the fact that it won Apple as a key customer. Throw Huawei into the mix too and the iPhone et al, with the Trump-baiting Chinese phones, all demand a huge amount of silicon manufacturing, and that’s something neither is going to want to hand over to a key smartphone rival and boost their bottom line.

A recent Financial Times article (behind a paywall) has reported comments from analysts on Samsung’s push to become the number one contract manufacturer by 2030. The push to overtake TSMC, which commands around 50% of the market, is seemingly driven by the slackening demand for memory chips. The first quarter of this year has seen Samsung’s operating profit drop by 60% mostly because dropping demand and an excess of memory in the channel have been driving prices down.

- New toys: Nvidia RTX 2080 Super review

So it’s turning to processor manufacturing instead in an effort to take a bigger slice of the reported annual $70bn contract production market. Though, according to the FT, “when Samsung told engineers in its flagship memory chip team that they were being moved to a division making processor chips, they often asked what they had done wrong.”

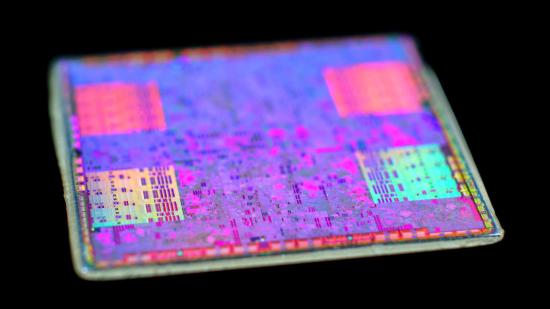

But, despite ploughing in $116bn into the project, Samsung is going to channel $63.5bn towards R&D with the rest being used for the building of new facilities to leverage the new learnings. That might sound like a lot of research cash, but in reality analysts are suggesting that only equates to roughly $5bn – $6bn as an annual R&D budget, while TSMC is expected to spend around $10bn – $12bn annually over the next few years.

That level of relative spend “would still say Samsung is going to be spending at a level to be the ‘number two’ foundry business,” says Credit Suisse analyst, Randy Abrams.

Which does explain why TSMC doesn’t sound particularly worried.

“We would never compete with our customers,” says TSMC’s director of corporate comms, Elizabeth Sun. “What we do [is] we collaborate with customers… Samsung competes with everyone. That doesn’t mean they will never get any foundry customers… But will they rely on Samsung the way they rely on TSMC?”

And when Apple is going to be driving TSMC’s burgeoning 5nm process in Autumn next year, around when Nvidia might have Samsung 7nm EUV chips in their new, potentially Ampere-powered, graphics card, you can see where the extra spending power of the Taiwanese is delivering results.

Join the conversation about Samsung’s manufacturing plans. Will it be Nvidia vs AMD all over again? Comment on this article’s Facebook and Twitter threads.