AMD are thriving on the new cryptocurrency mining business available to them through the Radeon Technologies Group. Historically, they have kept pretty tight-lipped on this matter, but it seems that approach has been dropped. AMD aren’t just openly discussing mining now, they are trying to entice you into setting up your high-end gaming rig for mining, too – and that’s not a good omen for us PC gamers.

Happy with your components? No worries, here are the best gaming keyboards around.

Yesterday, AMD spoke about how their Threadripper chips were surprisingly capable at churning a profitable hash rate. While this is certainly interesting in itself, it is what lies beneath this gesture that indicates changes to AMD’s often arms-length relationship with mining.

In their latest earnings call, AMD stated mining applications accounted for roughly one third of the growth from their computing and graphics business last year, but it comes at the cost of a strain on AMD’s potential market share for the gaming segment.

AMD president and CEO Lisa Su has been uneasy to proclaim too loudly that AMD is over the moon due to this new revenue stream. In their fourth quarter earnings call, Su indicated that AMD were aware of the low stock and high cost of GPUs, specifically offering a glimmer of hope to gamers with the phrase: “we are ramping up production.”

Speaking with technical marketing manager at AMD, Damien Triolet, however, AMD’s outlook seems to be a little less rosy for the foreseeable future.

“For us, mining is a very dodgy topic,” Triolet says. “We could go all-in and just advertise all our products as good for mining, but at the same time there is a situation with mining that is pushing GPU prices up, and causing some availability issues on some markets. To be realistic, we cannot do anything about that right now.“

The message from AMD seems to be that things aren’t realistically going to get much better for some time. While AMD are sure to be looking to shift unsold units from the CPU division with the Threadripper news, it is also somewhat concerning for 2018’s outlook in regards to PC component pricing.

“The way to go at this point is to try to explain to end users how they can also get the benefits of mining,” Triolet says, “because if you should get a high-end desktop with a high-end GPU today and you’re not mining, you’re kind of wasting money. If they are just sitting there doing nothing, why not make some nice profit?”

This move signals AMD embracing cryptocurrency mining as a part of their marketing strategy – it should come as somewhat of a warning to gamers. AMD have supported mining in the past with occasional driver releases, and some specific profiling inside them, but very little direct endorsement of mining to their regular user base.

It’s not just mining that has created a maelstrom of price gouging, limited availability, and angry gamers, however. All the necessary components soldered onto that PCB or slotted within your computer are seemingly in incredibly limited supply too.

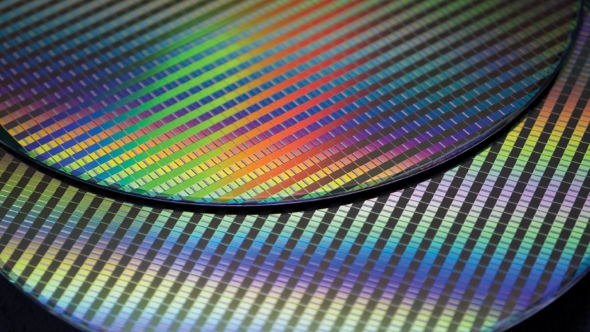

Silicon pricing has risen massively over the last year, and through 2018 it is only expected to skyrocket further in price. Pair that with the memory shortages, which Lisa Su and our own industry sources have confirmed, and you’ve already got a recipe for disaster, even without cryptocurrencies exponential growth factored in.

The only potential shake-up expected sometime in 2018 is Nvidia’s Volta launch, but memory shortages could still be a troubling factor, which could be another reason why we have still yet to see consumer versions of the green team’s latest GPU architecture.

The messaging from AMD seems to be clear. Any PC upgrade in the current market is going to be expensive, so advantageous people should be looking to cryptocurrency mining as a way to get some of that cash back.

But while Bitcoin may be barreling toward a fiscal cliff as we speak – despite highs of over $17,000 in January, it is now sinking below $9,000 – the blockchain technology looks like it is here to stay. We recently spoke with two blockchain-based companies hoping to utilise this mining power, effectively as decentralised servers, to support gamers in some way.

“We see that the blockchain is really a painkiller for the gaming industry,” Playkey CEO Egor Gurjev says. “So this can make all the games available to everybody, doesn’t matter what hardware you have, or how much money you have.”

Playkey are creating a decentralised network gaming streaming service through the blockchain. BestMeta are another startup utilising blockchain tech, but this time to support esports talent and offer fans transparent funding. These companies, along with many others, are giving the blockchain tech somewhat more sticking power through their proactive use of the technology, even in the face of further government regulation worldwide and understandable discontent among gamers about the wider cryptocurrency market.

Startups aren’t the only companies moving to accept the booming tech, however. Traditionally, many businesses have been resistant to adopting cryptocurrencies, mining, and the blockchain within their strategies, or relying on them for revenue, but there have been various signs beyond AMD that indicate this outlook may be changing.

Samsung recently confirmed they were shipping ASIC mining chips and TSMC are happily supplying chips for a similar purpose, even outstripping Nvidia’s demand. Mining is becoming big business, but these established companies also offer something else: legitimacy.

It’s certainly a change of heart for AMD, and should be an eye-opener for anyone hoping all this mining business goes away – it might not be going anywhere. Sure, AMD want to sell more CPUs and this move will be to their benefit, but they are also indicating something else to gamers: the blockchain is here to stay, prices are going to keep spiralling, and you’re going to be spending a lot of money on your components from here on out, so you should at least try and get something back.